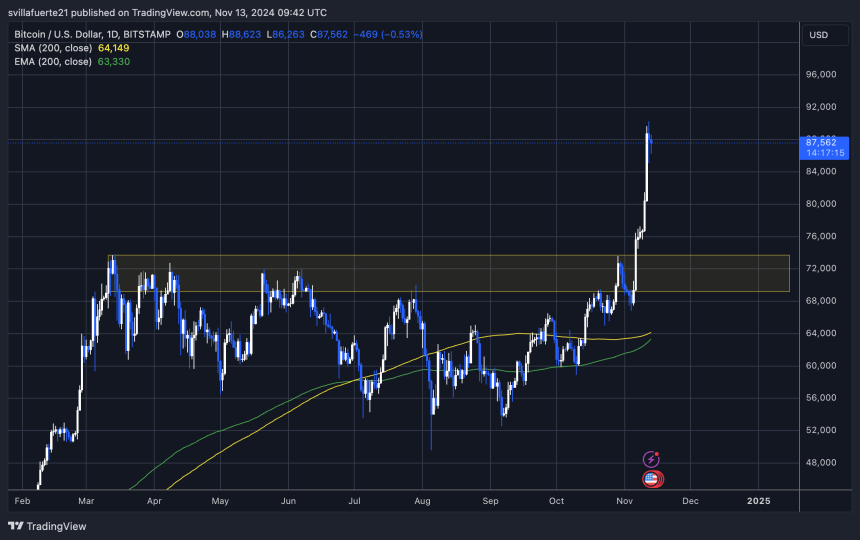

Bitcoin has reached a new all-time high of $90,243 following a week of relentless upward momentum. After days marked by euphoria and rapid gains, the price is now entering a consolidation phase, providing a much-needed pause for the market.

Key data from CryptoQuant indicates moderate selling pressure is emerging, which may signal a brief pullback or stabilization below the $90,000 mark.

Related Reading

This week will be pivotal in determining Bitcoin’s next steps as traders and investors watch if BTC will hold near the $90,000 supply level or retreat to test support around $80,000. With strong market fundamentals and continued interest from bullish investors, the potential for another rally remains high.

However, a short consolidation period could offer healthier groundwork for BTC’s long-term ascent. All eyes will be on whether Bitcoin can sustain its current levels or if this cooling-off phase will allow buyers to re-enter lower demand zones, setting the stage for the next major price move.

Bitcoin Selling Pressure Still Far From Peak Levels

Bitcoin has reached a local top after setting a fresh all-time high, signaling a potential pause in its recent surge. Analysts and investors are watching closely, as BTC has a history of making aggressive moves once it starts trending upward. Despite this bullish momentum, many are exercising caution, anticipating that Bitcoin might need time to consolidate before pushing higher.

According to key data from CryptoQuant analyst Axel Adler, the market is now experiencing moderate selling pressure. Adler’s analysis points to a possible consolidation phase, as short-term holders take profits. He specifically examines the short-term holder realized profit and loss data, which reveals that the current selling pressure is relatively mild compared to historical peak selling periods.

In Adler’s view, this moderate pressure suggests that BTC’s recent rally might not end. He highlights clusters of intense selling seen in previous peaks, marked as Clusters #1, #2, and #3 on his chart, showing levels of selling pressure significantly higher than what we see today. This data implies that while some profit-taking is underway, it’s nowhere near the intense levels seen at past tops.

Related Reading

As Bitcoin approaches consolidation, this subdued selling pressure could set the foundation for a more stable rally. Investors are eyeing this moment to gauge whether BTC will gather strength for the next leg up or continue cooling off, forming a solid base around current levels before another potential breakout.

BTC Testing New Supply Levels (Again)

Bitcoin has officially entered a much-anticipated price discovery phase, recently marking a new all-time high of $90,243. Currently trading around $87,500, BTC has experienced days of intense buying pressure and record-setting highs. However, the market may see a period of consolidation below the $90,000 threshold as traders assess new demand levels, potentially around $80,000.

The coming days will be critical in determining BTC’s short-term path. If Bitcoin holds above the $85,000 mark, this would signal resilience and likely encourage a push toward higher supply zones as bullish momentum builds. However, if BTC loses this level, a retracement to lower demand of nearly $82,000 could come into play, allowing for a more stable foundation before the next rally attempt.

Related Reading

Analysts view this consolidation phase as necessary after BTC’s rapid ascent, as it allows the market to establish support. Holding within the current range would signal strength, suggesting that BTC is well-positioned for further gains. Investors are now watching closely, gauging whether BTC will secure its recent gains or find a brief reset before aiming for new heights.

Featured image from Dall-E, chart from TradingView