Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Bitcoin (BTC) attempts to turn the $110,000 resistance into support, some analysts believe its price discovery rally has just started, forecasting new highs for the flagship crypto.

Related Reading

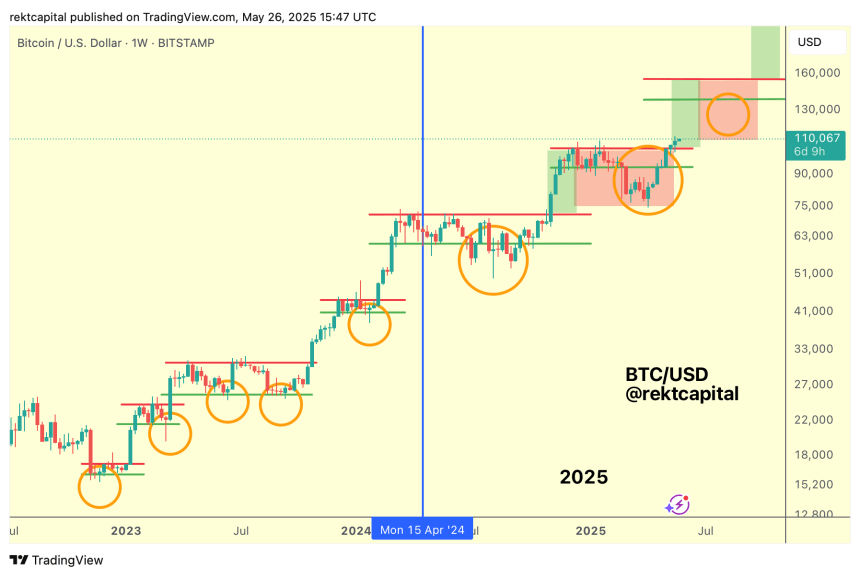

Bitcoin Starts Second Price Discovery Uptrend

Last week, Bitcoin’s momentum propelled its price to its new all-time high (ATH) of $111,814 before retracing to its current range. Over the weekend, Bitcoin confirmed its breakout into its second Price Discovery Uptrend, following its successful retest of the $104,500 mark as support.

The cryptocurrency has been in a significant market recovery for over a month, rallying nearly 50% from April lows. Analyst Rekt Capital noted that BTC ended its downside deviation period and positioned itself for a retest of its key re-accumulation range during early May’s surge, which was successfully reclaimed and surpassed.

The analyst considers that its new Price Discovery Uptrend has “only just begun,” as Bitcoin starts Week 2 of this phase. Rekt Capital highlighted that this cycle has been “a story of Re-Accumulation Ranges,” which signals that a new range will likely form after this Price Discovery.

Meanwhile, history suggests a second Price Discovery Correction is ahead as Bitcoin transitions into its new Price Discovery Uptrend.

During its future correction, BTC will likely retrace between 25%-35% “to produce yet another Downside Deviation below the Re-Accumulation Range Low (future orange circle) before resuming upside into a likely Price Discovery Uptrend 3.”

In the meantime, “All Bitcoin needs to do is hold above the Re-accumulation Range High of $104,500” to continue its price discovery rally.

$110,000 Breakout Next?

Notably, the flagship crypto has been retesting the range high as support over the past two weeks, confirming the breakout. As such, dipping into the previous $92,000-$104,500 range’s upper zone could happen as “part of normal volatility.”

Moreover, it turned another key resistance, the $102,500 mark, into support during this period, which it had previously been rejected from in January 2025. With these levels as support, Rekt Capital considers that only the December 2024 and January 2025 upwicks, at $108,353 and $109,588, stand in the way of additional Price Discovery.

Trader Daan Crypto Trades noted that Bitcoin is “still strong but fighting around its previous all-time high from earlier this year.” He pointed out that price action looks “very choppy” in the lower timeframes, but it shouldn’t be concerning for investors if the price remains within its current range.

Related Reading

Analyst MacroCRG affirmed that Bitcoin must officially reclaim the $110,000 level to continue its rally, as it marks the previous ATH and the Value Area High (VAH) from last week. “Acceptance above and we likely squeeze straight into price discovery again,” CRG stated.

Currently, Bitcoin is retesting its Weekly opening of $109,004 as support, which could set the stage for a breakout above the $110,000 mark if held. Meanwhile, rejection from this area could send BTC price to the $106,000-$108,000 area.

As of this writing, Bitcoin trades at $109,181, a 1.4% increase in the daily timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com