Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin continued its climb past $104,000 on Monday, and that rally has tempted some big traders to bet against it. A few high-stakes short positions now sit on the brink of collapse. These trades carry skinny margins for error and show just how risky huge margin bets can be when price momentum stays strong.

Related Reading

Massive Short Position At Risk

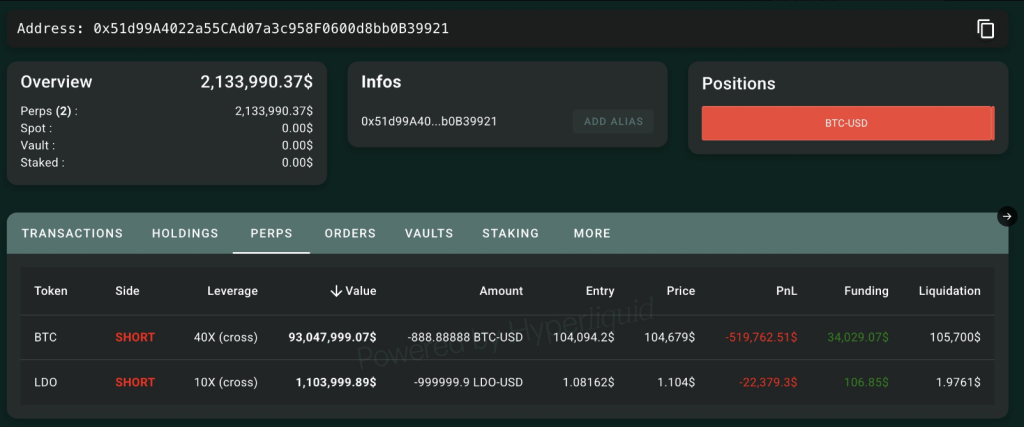

According to blockchain tracker Lookonchain, one whale wallet opened a $93 million short with 40× margin. At Bitcoin’s current level near $104,000, just a 1.5% uptick would force a shutdown at around $105,700. That means a small move could wipe it out. Right now, that position is sitting on over $500,000 in paper losses. It’s also earning about $34,000 in funding fees. But those earnings are tiny next to the loss, so they barely ease the pain.

Many gamblers are shorting $BTC with high leverage!

0x51d9 opened a $93M short position on $BTC with 40x leverage, with a liquidation price of $105,690.

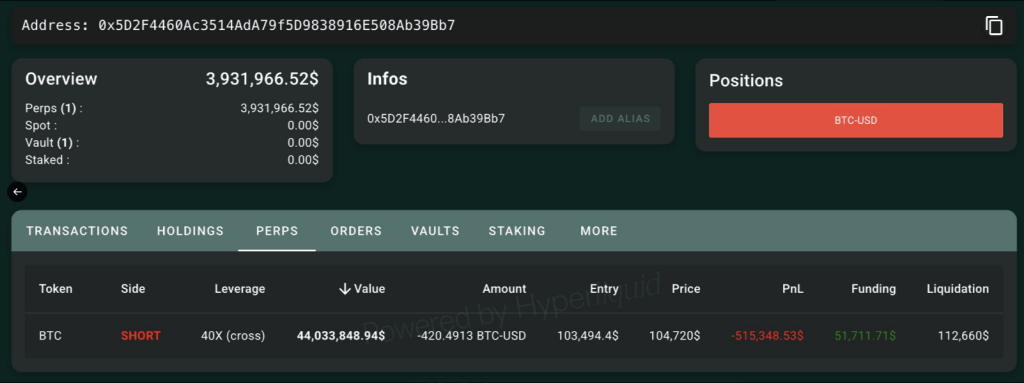

0x5D2F opened a $44M short position on $BTC with 40x leverage, with a liquidation price of $112,660.https://t.co/WcW1u4FdWz… pic.twitter.com/pAf1LEMnZp

— Lookonchain (@lookonchain) May 12, 2025

Second Whale Holding At Crossroads

Another account took a $44 million short at $103,494.40, again using 40× cross margin. Now that Bitcoin trades around $104,720, the trade is down roughly $515,348.53. Its liquidation threshold is much further out, at about $112,660. That gives a buffer of close to $9,000 before it’s wiped out.

So far, this trader has pocketed $51,711.71 in positive funding. Those credits show that traders are still betting on higher prices overall. Yet if Bitcoin’s climb stays on track, that buffer could evaporate fast.

Failed Bet Already Closed

A third whale got burned even sooner. This trader sold short $69.7 million worth of Bitcoin at $95,969, using 40× margin. Their cut-off price was $103,470. Bitcoin crossed that line days ago, trading above $104,000 in recent sessions. Based on reports, that position has almost certainly been liquidated already. It serves as proof of just how quickly high-risk shorts can backfire when prices shoot up.

Liquidations Highlight Market Pressure

Over the past 12 hours, Bitcoin derivatives saw $66.66 million in liquidations, with $51.25 million coming from shorts. In the full 24-hour stretch, a total of $82.58 million was wiped out, and $60.97 million of that was on the short side. Longs only accounted for $21 million in closures. These figures underline how much buying power has been forced back into the market, fueling further gains.

Related Reading

This frenzy shows that betting big against Bitcoin’s rally can end badly and fast. Small funding payments won’t make up for big losses if price keeps rising. Traders taking huge short positions now face steep odds of getting squeezed out. As Bitcoin sits above $104,000, any further gains could push more shorts to the exit, driving fresh volatility in the days ahead.

Featured image from Pexels, chart from TradingView