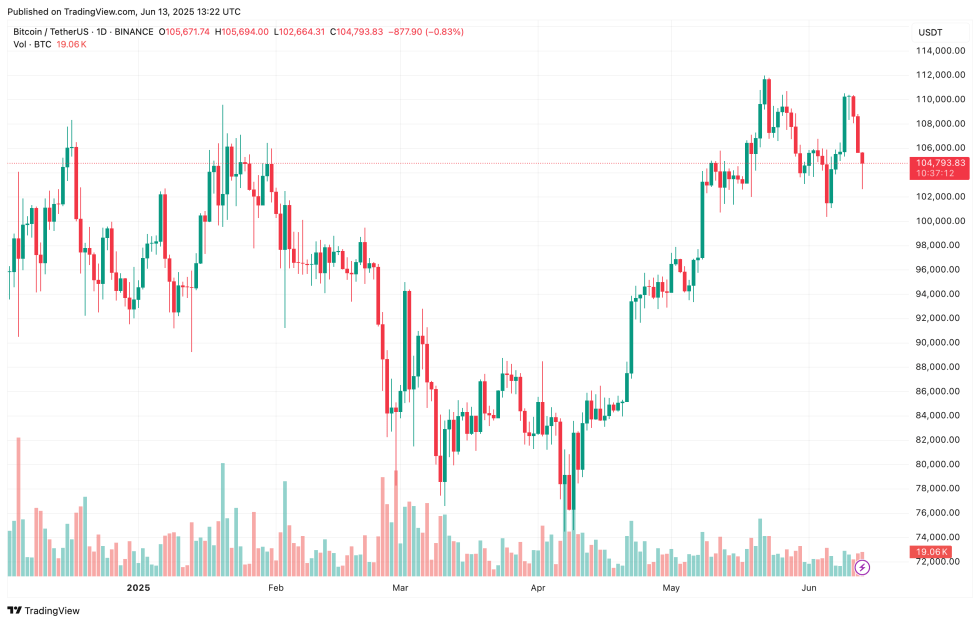

Despite a recent slump in Bitcoin (BTC) price driven by rising geopolitical tensions in the Middle East, overall market sentiment remains positive, with the leading cryptocurrency still trading in the mid-$100,000 range. Further, a key on-chain indicator suggests that the current BTC rally could still have more room to run.

Bitcoin Puell Multiple Suggests More Gains Ahead

According to a recent CryptoQuant Quicktake post by contributor Gaah, Bitcoin’s Puell Multiple suggests that the ongoing bullish rally may be far from over. The on-chain metric is currently hovering near the discount zone, below 1.40.

For the uninitiated, the Puell Multiple is an on-chain metric that compares the daily revenue earned by Bitcoin miners to its 365-day moving average (MA), helping to identify periods of potential market overvaluation or undervaluation.

Historically, values below 1.0 tend to indicate miner stress or market accumulation phases, while significantly higher values may signal overheated conditions or potential market tops. Commenting on the indicator’s recent behavior, Gaah noted:

This behavior of the Puell Multiple suggests that, despite the significant price appreciation, miners’ revenues have yet to follow suit – signaling that the market may be being driven by external forces, such as institutional demand, ETFs, or tightening circulating supply.

The contributor also pointed to the drop in block rewards following the April 2024 halving, which has likely exacerbated the revenue gap for miners – even as BTC prices rise on the back of broader adoption.

Gaah concluded that current conditions may represent a “potential window of opportunity” to accumulate BTC. The combination of elevated prices and subdued miner fundamentals suggests that the current cycle may have more upside potential in the coming months.

BTC Showing Signs Of Euphoria?

Retail interest in BTC remains muted compared to prior cycle peaks, but institutional interest continues to grow as adoption increases. An expanding number of entities are accumulating BTC, showcasing Bitcoin’s maturation as a legitimate store of value.

For example, GameStop recently announced plans to raise $1.75 billion through convertible notes, shortly after purchasing 4,710 BTC. This move echoes strategies employed by companies like Metaplanet and Strategy, which have also used debt financing to boost their BTC exposure.

Meanwhile, bullish forecasts for a new BTC all-time high (ATH) continue to emerge. Bitwise CEO Hunter Horsley recently predicted that BTC would likely face minimal resistance once it breaks past the $130,000 mark.

As for the timeline, crypto analyst Ted Pillows suggested that BTC could reach $130,000 as early as Q3 2025. At the time of writing, Bitcoin is trading at $104,793, down 2% in the past 24 hours.

Featured Image from Unsplash.com, charts from CryptoQuant and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.