Data shows Bitcoin sentiment on social media may be starting to become overheated, a sign that could end up being a threat to the price rally.

Bitcoin Social Media Sentiment Is Currently Notably Positive

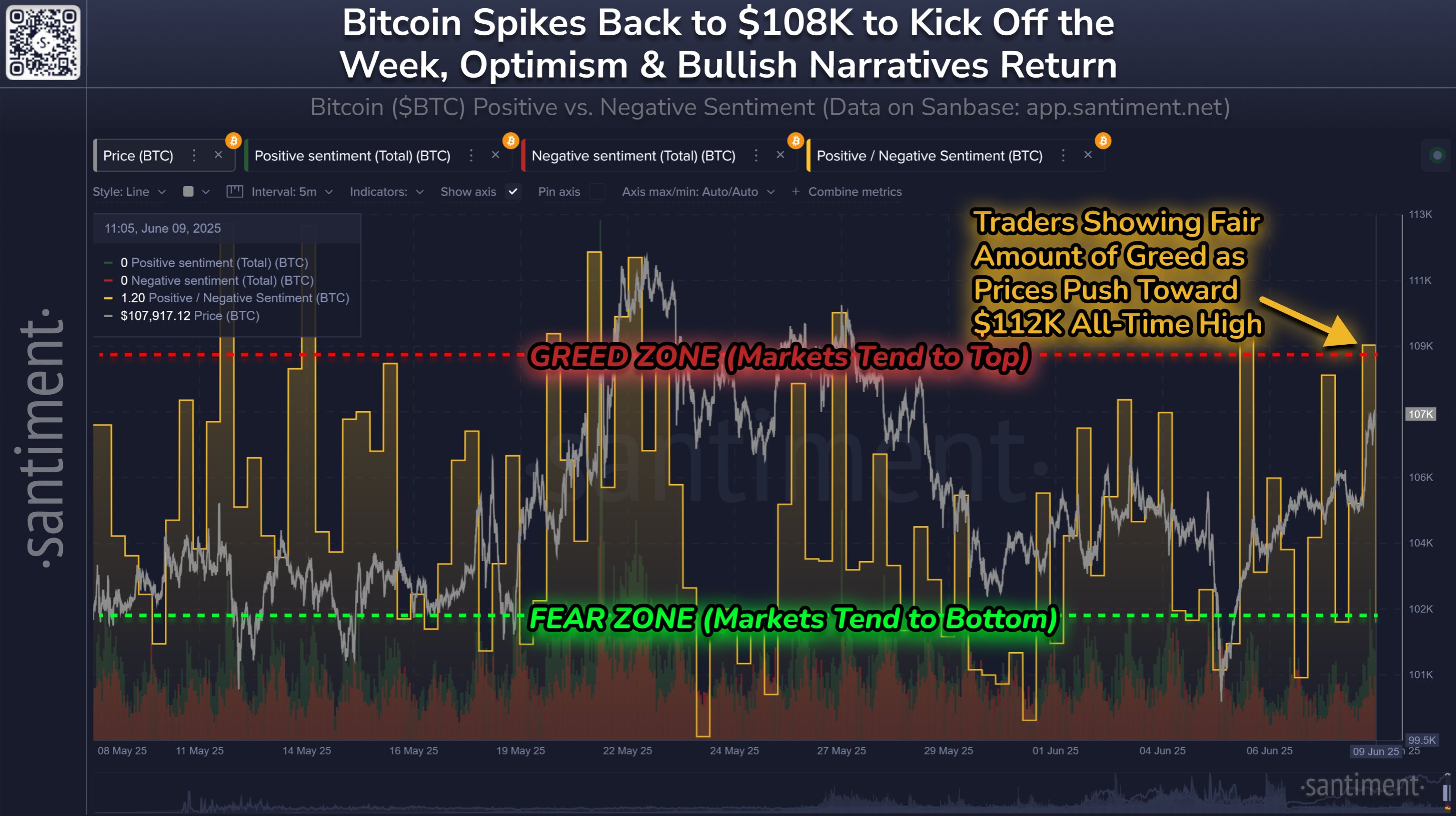

In a new post on X, the analytics firm Santiment has discussed how sentiment around Bitcoin has changed on the major social media platforms after the latest recovery rally.

The indicator of relevance here is the “Positive/Negative Sentiment,” which compares the level of positive sentiment to negative sentiment around a given cryptocurrency on social media.

The metric works by filtering posts/messages/threads containing mentions of the asset and putting them through a machine-learning model that separates between positive and negative comments. The indicator counts up the number of both types of posts and takes their ratio to provide a net representation of social media.

Now, here is the chart shared by Santiment that shows the trend in the Positive/Negative Sentiment for Bitcoin over the past month:

The value of the metric appears to have spiked in recent days | Source: Santiment on X

As displayed in the above graph, the Bitcoin Positive/Negative Sentiment has seen a spike in the zone above the 1.0 mark, which suggests a flood of positive posts related to the asset have hit social media platforms. This turn toward a significant positive sentiment has come as the cryptocurrency’s price has been going through a recovery surge.

This isn’t a particularly unusual trend, as excitement tends to rise among traders whenever bullish price action takes place. In the context of the latest surge, especially, an uplift of sentiment isn’t surprising, as it has brought the price close to the all-time high (ATH).

While some hype is to be expected, an excess of it can be something to watch out for. The reason behind this is the fact that Bitcoin and other cryptocurrencies have historically tended to move in the direction that goes contrary to the crowd’s opinion.

This means that a surge of greed in the market is something that can lead to a top for the asset’s price. Similarly, a cooldown in sentiment can imply a bullish reversal instead.

From the chart, it’s apparent that the Positive/Negative Sentiment declined to a relatively low level a few days ago when Bitcoin saw a drawdown toward $100,000. This fear among social media users may have helped the coin reach a bottom.

After the latest spike in the indicator, the situation is now the opposite, with Fear Of Missing Out (FOMO) potentially developing among the investors. It now remains to be seen whether this overexcitement would provide impedance to the price rally or not.

BTC Price

Bitcoin briefly broke above $110,000 during the past day, but the asset has since seen a minor pullback as it’s now back at $109,500.

The trend in the BTC price over the last five days | Source: BTCUSDT on TradingView

Featured image from iStock.com, Santiment.net, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.