Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Spot Bitcoin ETFs ripped in $2.75 billion this week, and that haul was nearly 4.5 times last week’s $608 million. Prices jumped past $109,000, a high not seen since January. Bitcoin even touched $111,980 on May 22. Investors piled in as the rally took hold.

Related Reading

Spot Bitcoin ETF Inflows Surge

According to Farside data, spot Bitcoin ETFs drew $2.75 billion this week, up sharply from $608 million the week before. That big jump came as Bitcoin pushed past its January all-time high of $109,000.

On May 21, investors added $607 million, the same day Bitcoin hit a new peak. Then, on May 22, the coin soared to $111,980. Those moves show money chasing fresh highs.

BlackRock’s IBIT Leads Flows

Based on reports, ETF flows on May 23 totaled just $212 million, but BlackRock’s IBIT was the only one in the green. It brought in $431 million all by itself, and that stretched its inflow streak to eight days straight.

Meanwhile, Grayscale’s GBTC saw $89 million leave, and ARK 21Shares’ ARKB lost $74 million. Investors seem to favor the low fees and wide reach of the biggest funds.

Market Sentiment Pulls Back

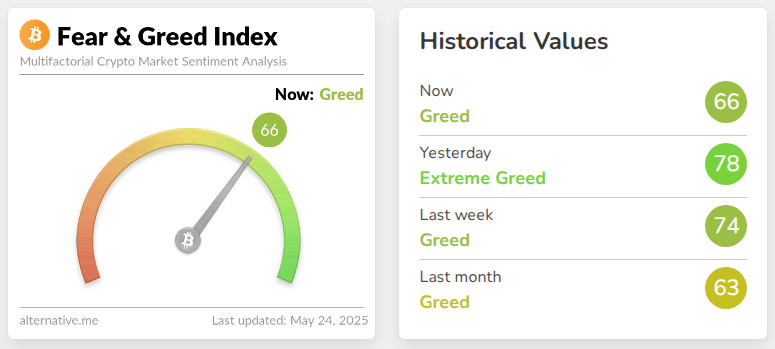

Bitcoin’s climb paused a bit after that. At publication, it traded near $108,150. The Crypto Fear & Greed Index slid from an “Extreme Greed” reading of 78 down to 66, or “Greed.” That dip hints at some profit-taking.

CryptoQuant analyst Crypto Dan said on May 22 that “overheating indicators such as the funding rate and short-term capital inflow remain low compared to previous peaks, and profit-taking by short-term investors is limited.” His view is that this rally hasn’t been driven by risky bets.

Related Reading

Record Monthly Inflows In Sight

So far in May, spot Bitcoin ETFs have pulled in about $5.40 billion. The previous monthly high came in November 2024, when ETFs took in $6.50 billion.

With five trading days left in May, inflows could set a new mark. That steady demand underlines how ETFs have become the go-to way for many to own Bitcoin without wrestling with wallets and private keys.

Demand for spot Bitcoin ETFs has grown fast. Investors like simple, regulated products. The big issuers, led by BlackRock, have the best chance to stay on top.

As for Bitcoin itself, if sentiment cools, prices might pull back some. But with institutional flows so strong, many see room to run higher.

Featured image from Gemini Imagen, chart from TradingView