Bitcoin is holding strong above the $110,000 level after breaking its previous all-time high on Wednesday, signaling the potential start of a massive bullish phase. The breakout marks a significant psychological and technical milestone, reigniting optimism across the crypto market. With bulls firmly in control, analysts are closely watching price action as BTC enters uncharted territory.

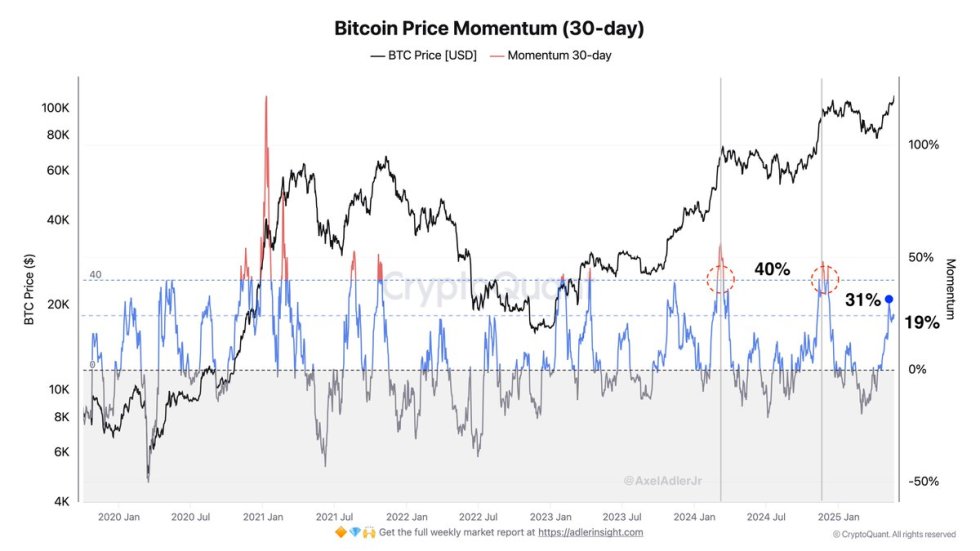

However, despite the excitement, the rally is showing early signs of cooling. According to on-chain data from CryptoQuant, current momentum has slowed by 38% following the breakout, an expected technical cooldown after reaching new highs. Historically, Bitcoin often consolidates or retraces shortly after breaching all-time high levels, allowing the market to reset before continuing its upward trend.

Still, the slowdown isn’t necessarily a bearish signal. It may reflect healthy market behavior, giving participants time to reposition and reinforcing the foundation for a sustained move higher. As long as BTC holds above key support levels near $105K, analysts remain confident in the broader bullish structure. Whether this consolidation leads to an impulsive rally toward $120K or a short-term retrace remains to be seen, but one thing is clear: Bitcoin is back in price discovery mode, and the next move could be decisive.

Bitcoin Faces Crucial Test Amid Recession Fears

Bitcoin is entering a pivotal phase as it trades above the $110K level, facing both macroeconomic headwinds and growing investor optimism. While fears of an impending recession and tighter financial conditions continue to dominate headlines, Bitcoin’s price action tells a different story—one of strength and resilience. In fact, BTC has steadily climbed higher despite rising bond yields, weakening equity markets, and widespread uncertainty, highlighting its evolving role as a hedge against traditional market instability.

However, for this bullish narrative to hold, Bitcoin must decisively break above the $115,000 level. Doing so would confirm the start of a new impulsive leg upward and potentially attract more institutional capital as the asset enters full price discovery mode. Until then, BTC remains in a critical zone that could define its trend for the coming weeks.

According to top analyst Axel Adler, the current rally has naturally decelerated, with momentum slowing by 38% following the all-time high breakout. Adler explains this as a “technical cooldown,” a normal pattern where the market consolidates or pauses after reaching major milestones. This “breather” allows leveraged positions to unwind, liquidity to reset, and investor sentiment to stabilize before a potential next leg higher.

Despite macro concerns, the price structure remains firmly bullish, and short-term consolidation may ultimately strengthen the foundation for another surge. If BTC can maintain current levels and absorb overhead resistance, the path toward $120K could come sooner than expected. Until then, all eyes remain on Bitcoin’s behavior at the $115K barrier—a critical mark that could define whether this rally has more fuel or if a correction is due.

BTC Holds Above $111K: Momentum Slows After Breakout

The 4-hour chart for Bitcoin (BTC/USDT) reveals a strong uptrend, with price currently consolidating around $111,000 after reaching a new all-time high at $111,356. Price action remains bullish, holding above the 34 EMA (green), 50 SMA (blue), and key support levels at $103,600 and $100,000. This structure indicates a healthy continuation pattern, where BTC is taking a breather after an explosive rally from below $100K.

Volume has tapered slightly, supporting CryptoQuant’s insight that momentum has cooled by 38%—a normal pause after reaching new highs. Moving averages are sharply upward-sloping, with the 200 SMA (red) far below current price, reflecting strong bullish momentum and wide separation from longer-term trends.

The current consolidation zone resembles a flag or pennant formation, which typically precedes another leg up if buyers step in with volume. However, traders should monitor any sharp drop below $107K, which would signal fading momentum and increase the risk of a correction toward the $103,600 support.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.