Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

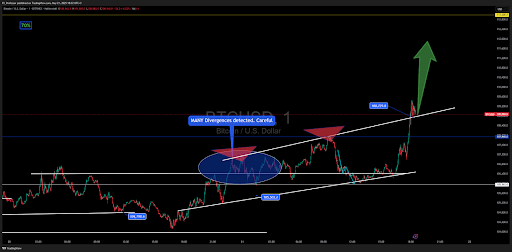

Bitcoin’s price action in the past 24 hours has been nothing short of remarkable. After consolidating for several days in a tightening range, the market broke past the $105,503 support-turned-resistance zone earlier in the week and kicked off a steep climb in the past trading day. This has allowed Bitcoin to push into new all-time high levels, and is showing no signs of slowing down.

Interestingly, technical analysis shows the rally comes off an approach of a golden cross between the 50 and 200-day moving averages, but FX_Professor offered a different take on the much-celebrated golden cross.

Analyst Disputes Golden Cross Hype As Late Signal

In a recent analysis published on TradingView, FX_Professor discussed a different take on Bitcoin’s golden cross. While most market commentators interpret this crossover of the 50-day simple moving average above the 200-day as a strong bullish confirmation, the analyst dismissed it as a delayed indicator. The analyst described it as the afterparty where retail investors arrive late to the scene.

Related Reading

Instead of waiting for the golden cross to flash green, FX_Professor noted pre-indicator pressure zones as the real signal of value. In the case of Bitcoin’s price action in recent months, the analyst pointed out the $74,394 and $79,000 region as the zone of accumulation and early positioning, well before the golden cross became visible. As such, by the time the cross appeared recently, Bitcoin’s price action had already been up significantly.

The golden cross is often used by traders as a signal to enter a long position, as it suggests that the asset’s price is likely to continue rising. However, this analysis follows a trend among experienced traders who view the golden cross as more of a lagging confirmation than a trigger of a rally.

Early Entry Zones And Structure Matter More, Analyst Says

According to FX_Professor, indicators such as EMAs or SMAs can be useful but should never come before understanding the price structure, trendlines, and real-time pressure zones. He shared a snapshot of his own Bitcoin price chart that combines custom EMAs with a signature parallelogram method to detect where price tension begins to build. Visible on the chart are entries forming as early as April when Bitcoin bounced off support around $74,000, long before the crossover confirmation.

Related Reading

Now, with Bitcoin pushing toward the next target zone near $113,000, the analyst’s strategy continues to validate itself in real time. Nonetheless, the confirmation of a golden cross is still bullish for Bitcoin’s price action moving forward, even if the price rally is already halfway to its peak level.

At the time of writing, Bitcoin is trading at $110,734. This marks a slight pullback from the new all-time high of $111,544, which was registered just three hours ago. The Bitcoin price is still up by 3.1% in the past 24 hours, and new all-time highs are possible before the weekly close.

Featured image from Getty Images, chart from Tradingview.com