Bitcoin (BTC) is now less than 5% away from its all-time high (ATH) of $108,786, recorded earlier this year in January, and recent price momentum suggests the digital asset is likely to breach that level soon. In anticipation, a significant amount of BTC is being withdrawn from exchanges, according to on-chain data.

Bitcoin Pulled Off Exchanges As It Flirts With ATH

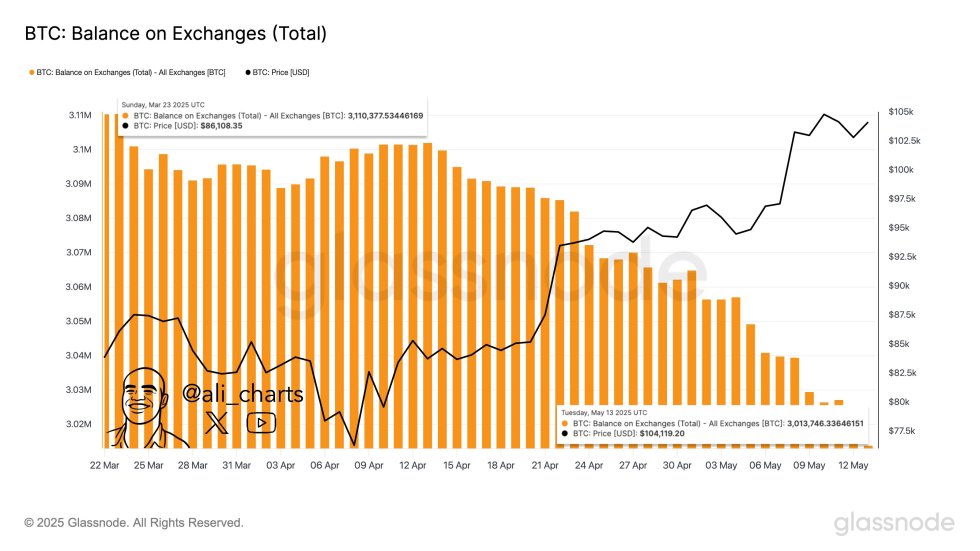

In an X post published today, seasoned crypto analyst Ali Martinez noted that 100,000 BTC has been withdrawn from crypto exchanges over the past three weeks. While BTC exchange reserves hovered around 3.11 million on March 22, they have since declined to less than 3.02 million as of May 13.

Falling BTC exchange reserves could amplify the flagship cryptocurrency’s “supply scarcity” narrative, potentially triggering a sharp price increase in a short span. Additional data also indicates that more investors are accumulating BTC at current price levels.

In a separate X post, Martinez highlighted a rising Accumulation Trend Score (ATS), supported by the recent BTC price rally. Historically, a surge in ATS has often preceded major rallies in BTC price. A rise in ATS also reflects growing confidence in broader macroeconomic conditions.

Several other catalysts could drive BTC prices higher in the short term. For instance, if BTC surpasses $105,244, it could trigger a short squeeze of approximately $25.38 million.

Moreover, crypto analyst Jelle pointed out that Bitcoin has formed a lower-timeframe Power of Three setup. A successful completion of this pattern could push BTC to a new ATH, potentially around $112,000.

For the uninitiated, the Power of Three is a market structure where price typically follows a three-phase cycle – accumulation, expansion, and distribution. It is often used to anticipate smart money behavior and identify high-probability trade setups.

Additionally, noted crypto analyst Ash Crypto remarked that BTC’s weekly Moving Average Convergence Divergence (MACD) has confirmed a bullish crossover. The analyst shared the following chart, noting that historically, such a signal has often preceded strong upward momentum in BTC price.

Calm Before The Storm?

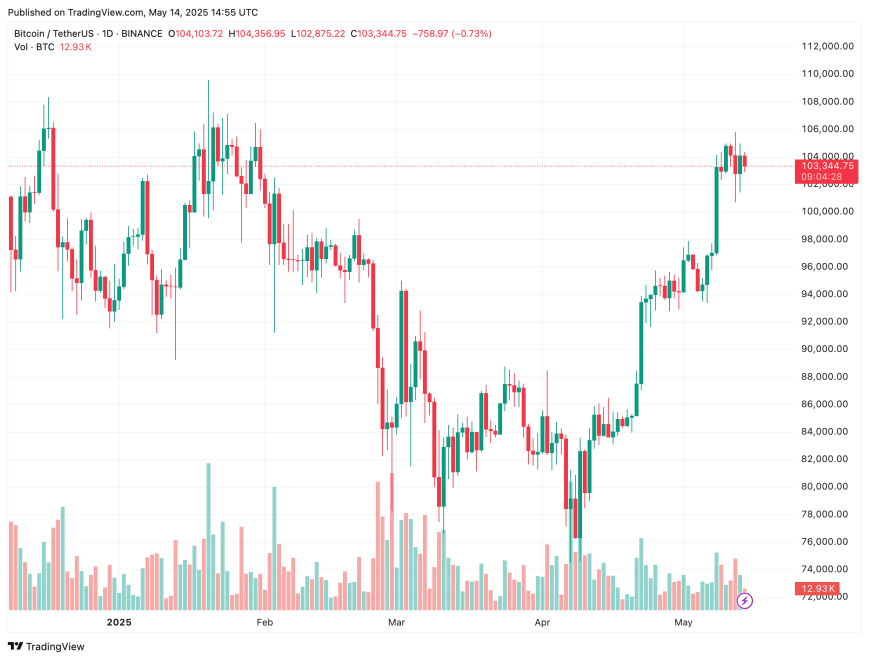

Currently, Bitcoin appears to be consolidating in the low $100,000 range. However, TradingView crypto analyst RLindia predicts that the price is likely to break out to the upside, potentially reaching a new ATH between $106,000 and $110,000.

That said, BTC’s lack of a strong reaction to favorable news could be a concern. Recently, the digital asset failed to show significant positive momentum despite the US CPI data for April 2025 coming in lower than expected. At press time, BTC is trading at $103,344, up 0.2% in the past 24 hours.

Featured Image from Unsplash.com, charts from X and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.