Bitcoin is under pressure as bullish sentiment begins to fade and sellers regain control. After weeks of strength, BTC is now testing the critical $92,000–$93,000 support zone, attempting to confirm this level as a base for continuation. However, if selling pressure continues to rise, a breakdown below this area could trigger a sharper correction and signal a weakening trend.

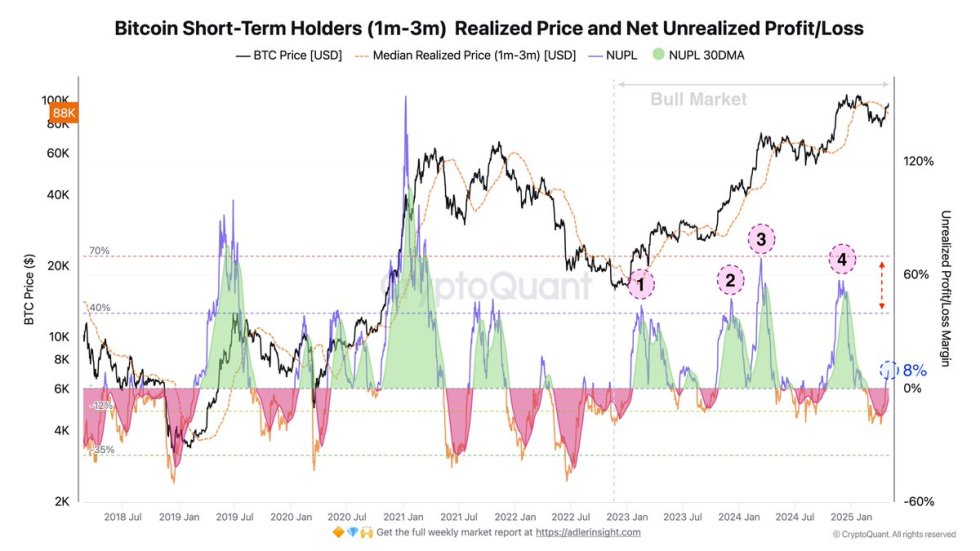

Top analyst Axel Adler shared insights that highlight a key risk factor: in the current bull cycle, short-term holders tend to take profits once their Net Unrealized Profit and Loss (NUPL) exceeds 40%. Historically, this level marks the point where speculators begin to offload their positions, increasing spot market supply and creating downward pressure on price. With Bitcoin recently showing signs of stalling near $98,000 and momentum cooling, traders are growing cautious.

Although the structure remains intact for now, BTC must hold the $92K region to avoid flipping key support into resistance. A clean bounce from this level could revive the bullish case, but failure to hold could shift sentiment further bearish. As market participants watch closely, Bitcoin faces one of its most serious tests in this cycle. The next move may define the trend for weeks to come.

Bitcoin Enters Pivotal Range: Buyers Target $100K Breakout

Bitcoin is trading within a crucial price range, where a drop below $90,000 could trigger a shift in momentum toward the downside, while a breakout above $100,000 could spark a powerful new leg of the bull cycle. After enduring months of selling pressure from its all-time highs, BTC is showing renewed strength and attempting to confirm a broader bullish setup for the entire market. The recent push above $92K was a key technical step, but now bulls must defend that level and build momentum toward a sustained breakout.

Market conditions, however, remain volatile. The current environment is shaped by macroeconomic uncertainty and rising geopolitical tensions, creating unpredictable swings across crypto and traditional markets. Still, Bitcoin’s price structure suggests bulls are gaining the upper hand—at least for now.

Adler shared insights on the role of short-term holders (1–3 months), who are often the most aggressive market participants. This group includes professional speculators, many of whom trade Bitcoin via ETF platforms. Historically, in this bull cycle, when their Net Unrealized Profit and Loss (NUPL) exceeds 40%, they begin to take profits, causing sell pressure. Currently, NUPL sits at just 8%, with its 30-day SMA still negative at -2%, signaling that short-term holders are not yet selling in large numbers.

This low NUPL level suggests minimal immediate selling risk, which reinforces the bullish case. As long as NUPL remains subdued, Bitcoin could have room to continue climbing before profit-taking begins. The coming days will be critical—holding above $90K and building toward $100K could open the door for a breakout, while failure to do so may usher in renewed weakness. All eyes remain on Bitcoin as it stands at a decisive moment in this cycle.

Price Action Details: Holding Strong But Facing Resistance

Bitcoin is currently trading around $94,158 after a modest pullback from the recent local high near $97,000. The daily chart shows that BTC remains well above both the 200-day simple moving average (SMA) at $90,542 and the 200-day exponential moving average (EMA) at $86,381, suggesting that the broader trend remains bullish.

After breaking through the key $90K level in April, Bitcoin rallied strongly but is now consolidating just below the psychological $100K resistance. Volume has started to taper off, indicating short-term indecision as bulls and bears battle for control. A continued hold above $92K would reinforce the bullish case, potentially setting the stage for a renewed breakout toward $100K and the previous cycle high of $103,600.

However, a breakdown below $92K could signal a loss of momentum and increase the likelihood of a retest of the 200-day SMA near $90K. This level now serves as crucial support and will be closely watched by traders.

Overall, Bitcoin remains structurally strong, but the next few daily candles will be critical. A decisive move above $97K could ignite the next leg up, while a loss of $90K would risk flipping the trend short-term bearish.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.