Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Avalanche (AVAX) has been one of the standout performers in recent weeks, surging more than 53% since March 11 as bulls attempt to kickstart a broader recovery rally. The strong rebound follows a brutal correction in which AVAX lost over 72% of its value since mid-December 2024, triggering widespread capitulation and fear across the market. Now, with price action showing signs of strength, investors are cautiously optimistic — but uncertainty remains.

Related Reading

While the recent rally has brought some relief, many analysts believe the market may be entering a consolidation phase. AVAX is currently struggling to hold above the $22 mark, a key resistance level that could determine whether the uptrend continues or stalls. Several technical signals are flashing caution as momentum begins to slow.

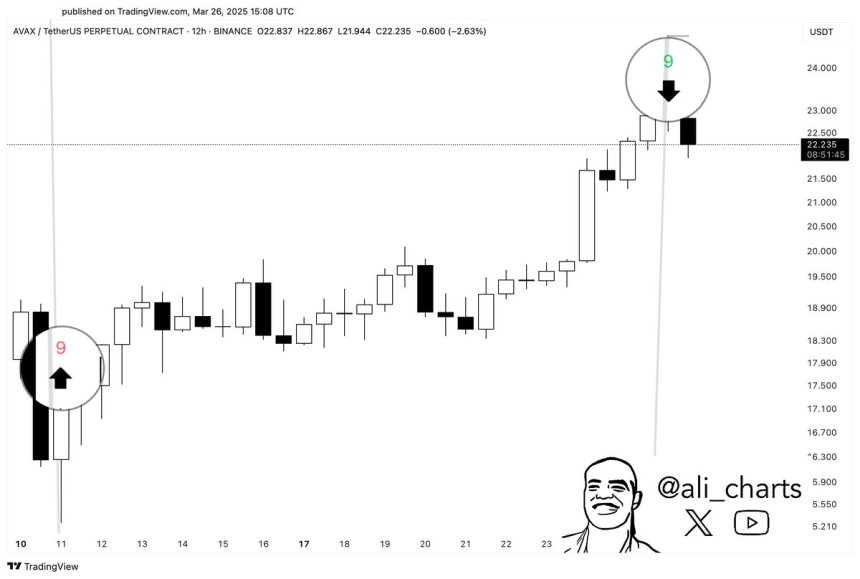

Top analyst Ali Martinez shared insights on X, pointing out that the TD Sequential indicator is now presenting a fresh sell signal. This suggests that AVAX may be due for a short-term pullback or a period of sideways movement. With the broader market still under pressure, traders are watching closely to see whether Avalanche can maintain its gains or lose momentum.

Avalanche Wakes Up But Faces Serious Risks

Avalanche is showing signs of life after enduring months of intense selling pressure. Like many altcoins, AVAX has been heavily impacted by macroeconomic volatility, losing over 70% of its value since mid-December 2024. Now, as bullish momentum begins to return across select altcoins, Avalanche is attempting to stage a recovery rally. The recent 53% surge since March 11 has revived hopes that AVAX could be ready to break out — but headwinds still remain.

The broader market environment continues to be shaped by uncertainty. Trade war fears and unstable macroeconomic signals have kept pressure on risk assets, including cryptocurrencies. Many investors remain cautious and are still offloading positions near current levels, concerned about the long-term direction of the market. While momentum is returning to some sectors, the path for Avalanche is far from clear.

Top analyst Ali Martinez recently highlighted a technical development using the TD Sequential indicator. After accurately calling the recent bottom and a 50% rally in AVAX, the indicator is now flashing a sell signal. This suggests that Avalanche could be due for a short-term retrace or period of consolidation before any further move higher.

The $22 level remains a crucial resistance zone for AVAX. A temporary cooldown here may be healthy — giving bulls time to regroup before attempting a breakout. If AVAX can hold key support and reset after the current rally, it could build a stronger foundation for a decisive push above $22 in the weeks ahead. For now, all eyes are on price action as Avalanche balances between correction and continuation in a market still clouded by uncertainty.

Related Reading

AVAX Struggles Below $22 As Bulls Aim For $30 Breakout

Avalanche (AVAX) is currently trading at $21.80 after briefly reaching $23.40 just two days ago. The recent pullback reflects cooling momentum as bulls struggle to maintain pressure near short-term resistance. Still, the trend remains intact — for now. To sustain the recovery rally, bulls must defend current levels and push toward reclaiming the $30 mark, which aligns with the 200-day moving average (MA) and 200-day exponential moving average (EMA). A successful breakout above this zone would be a strong bullish signal and could mark the beginning of a larger uptrend.

However, failure to hold above $20 in the coming days would be a warning sign. A breakdown below this level could trigger increased selling pressure and send AVAX back toward the $17 zone — a key support area from previous consolidations. As Avalanche continues to trade within a volatile range, the next few sessions will be crucial in determining short-term direction.

Related Reading

With the market still under macroeconomic pressure, bulls must act quickly to maintain momentum. A decisive move above $30 remains the target, but holding the $20 level is just as important to avoid a deeper retrace and renewed bearish sentiment.

Featured image from Dall-E, chart from TradingView