Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

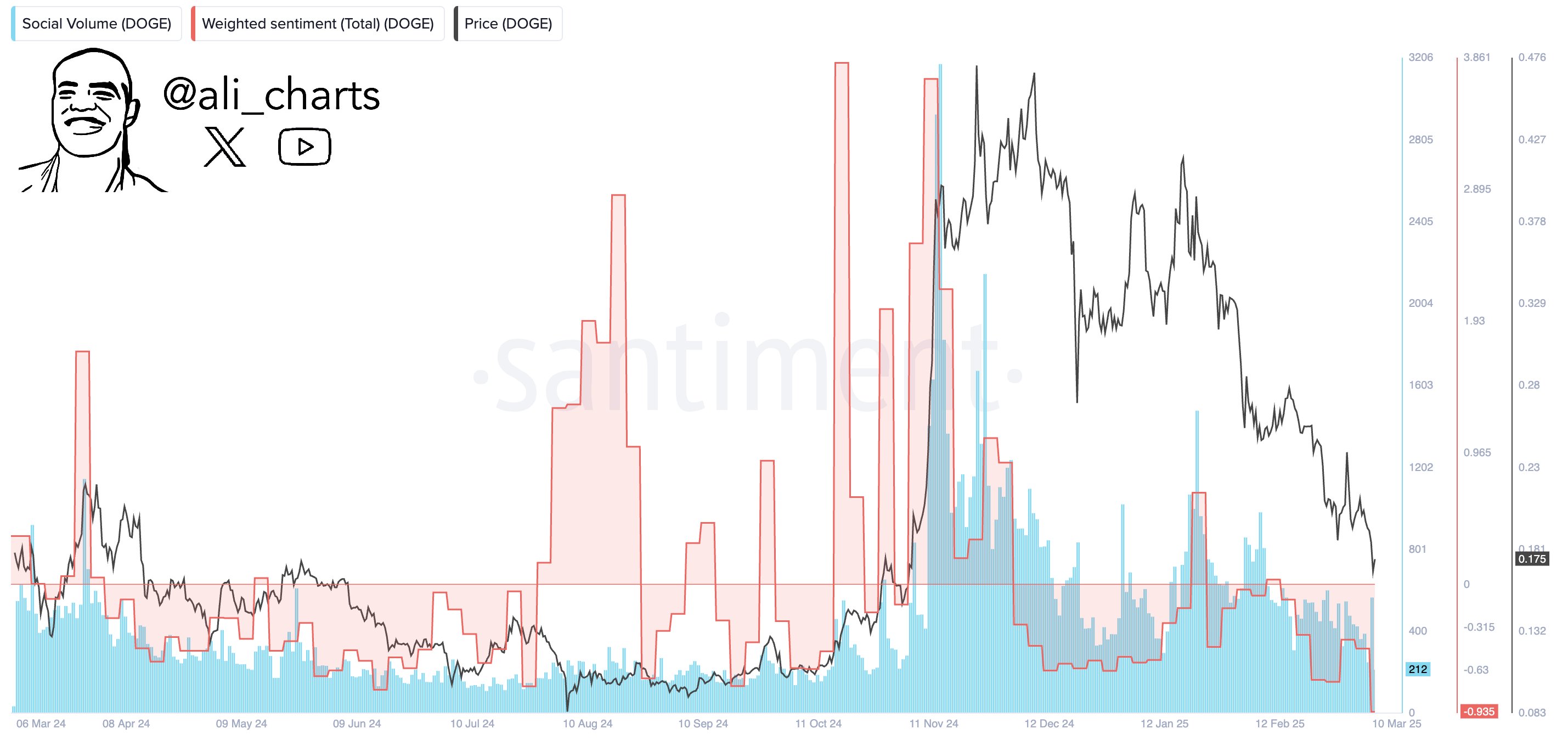

Dogecoin’s sentiment has reportedly reached its most negative level in over a year. Crypto analyst Ali Martinez (@ali_charts) shared the below chart illustrating the current landscape of Dogecoin’s social sentiment and noted: “Investor sentiment around Dogecoin is at its most negative in over a year. Historically, extreme fear has set the stage for major reversals. This could be a prime opportunity to be a contrarian.”

What This Means For Dogecoin

Within the chart, the red line—the Weighted Sentiment—now sits at approximately -0.93, marking the steepest negative reading in more than 12 months. Weighted Sentiment considers both the volume of social media mentions (Social Volume) and the overall polarity of discussions (positive vs. negative). Spikes above zero typically indicate widespread bullish sentiment (and can coincide with surging prices), whereas sharp dips suggest that market participants are overwhelmingly bearish.

Related Reading

Alongside this negative turn in Weighted Sentiment, the chart’s blue bars—Social Volume—show moderate levels compared to the dramatic spikes seen mid-November through December. In that period, Social Volume soared above 3,000 mentions, correlating with extremely positive Weighted Sentiment (above +3 on the chart) and a substantial price rally.

Now, Social Volume hovers around just over 200 mentions, which underscores that while negative sentiment dominates, the overall conversation frequency about DOGE is relatively low.

Related Reading

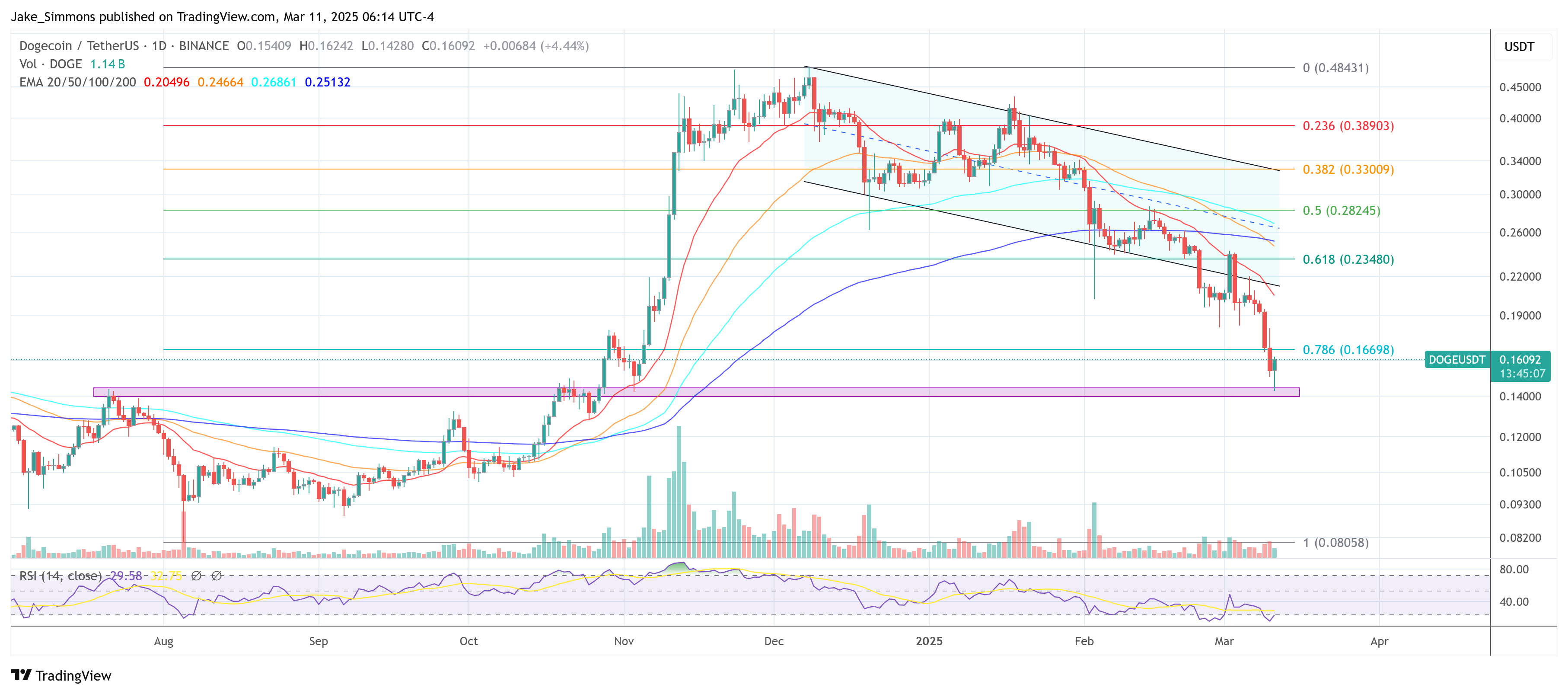

Another popular analyst, Lumen (@Lumen0x), points out that Dogecoin has dropped 20% in a week—sliding from $0.22 to $0.17. Despite the pullback, whale addresses reportedly scooped up 1.7 billion DOGE (approximately $298 million) in the past 72 hours, suggesting that bigger players might be positioning for an eventual rebound.

Lumen also speculates that a potential Dogecoin ETF approval could act as a bullish catalyst. According to him, if Dogecoin’s price reclaims $0.20 ahead of any ETF-related announcement, it could pave the way for a surge toward $0.50, citing the liquidity these investment vehicles could bring and the possibility of renewed social media excitement.

According to Lumen, the immediate support sits around $0.17–$0.18, reflecting recent lows on the chart. The psychological pivot point is at $0.20, a level frequently mentioned by analysts as a key threshold for bullish continuation. A mid-term potential upside target is at $0.50, per Lumen’s outlook if significant market catalysts (e.g., an ETF) materialize.

Overall, Dogecoin’s plunge in social sentiment underscores the volatility intrinsic to meme-based cryptocurrencies. The Sentiment Weighted metric’s deep dive suggests that the bulk of social media commentary has taken a distinctly pessimistic turn. Yet, some analysts like Martinez and Lumen believe this extreme negative sentiment could mark the start of a rebound, especially in light of notable whale accumulation and potential ETF catalysts on the horizon

At press time, DOGE traded at $0.16.

Featured image created with DALL.E, chart from TradingView.com