Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has extended its decline below $90,000 as on-chain data shows whales selling off in massive amounts. This price decline comes amidst the otherwise bullish news of Donald Trump signing an executive order for a Strategic Bitcoin Reserve (SBR). The lack of bullish momentum despite this has brought into play the possibility of an extended bearish move from here.

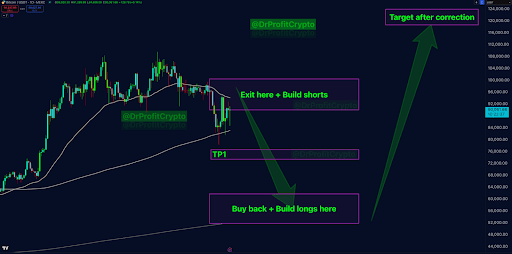

A well-known crypto analyst, Doctor Profit, has raised alarms about an impending major correction in Bitcoin’s price. In a detailed post on social media platform X, he outlined his reasons for this shift, arguing that the current market conditions signal the start of the first large Bitcoin correction of this cycle.

Strategic Bitcoin Reserve: A Misinterpreted Narrative?

Popular crypto analyst Doctor Profit revealed that he is selling a significant portion of his holdings and entering short positions. Notably, the analyst pointed to the recent news surrounding the Strategic Bitcoin Reserve as a key factor that led him to reevaluate his bullish stance. He emphasized that while retail investors see this as a game-changing development, large players and whale investors have already priced in the impact.

Related Reading

Many crypto investors expected an accumulation of Bitcoin by the US government in order to strengthen the reserve. However, instead of the expected ensuing buying pressure on Bitcoin, the executive order focused on Bitcoin confiscated from previous seizures, which left bullish investors underwhelmed.

According to Doctor Profit, the decision to sign off on this policy earlier than anticipated signaled a shift in market dynamics. His expectation was that this move would materialize months later, allowing Bitcoin’s price to sustain upward momentum before the first significant correction. Instead, he now sees this as the primer for a long-term decline.

Is This The Beginning Of Bitcoin’s First Big Correction? Price Levels To Warch

Doctor Profit firmly believes that Bitcoin has yet to experience a proper correction in this cycle, noting bull market trends where the asset has seen at least one 40-50% drop before reaching new all-time highs. He sees the recent developments as the final push before a 40% to 50% decline. As such, the analyst noted that this is the ideal window for distributing sell orders and entering short positions.

Related Reading

His outlook suggests a retracement to as low as $50,000–$60,000 before Bitcoin resumes its long-term bullish trajectory. Breaking down his trading strategy, he disclosed that he has already sold 50% of his Bitcoin holdings, which he accumulated at $16,000. He has placed short orders within the $90,000–$102,000 range, with target profits set at $74,000 for the first take-profit level, followed by a complete exit in the $50,000–$60,000 region and a full buyback to double holdings.

Despite his short-term bearish outlook, the analyst maintains that Bitcoin will eventually rally to new highs in the $120,000–$130,000 range. At the time of writing, Bitcoin is trading at $86,530.

Featured image from Unsplash, chart from Tradingview.com