David Sacks, the White House’s Special Advisor for AI and Crypto, described upcoming U.S. crypto policy.

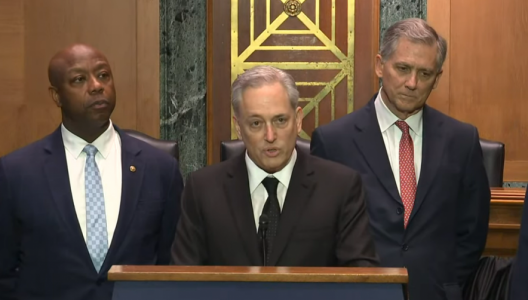

White House Crypto Czar David Sacks and various others laid out the Trump administration’s plans for digital assets in a press conference on Feb. 4.

Sacks announced details of a bicameral working group on digital assets that was established by an executive order in late January.

He said that policies originating from the group are intended to strengthen the U.S. crypto industry and give crypto companies room to work.

Sacks asserted that company founders primarily want regulatory clarity, stating:

“We’re coming off of frankly four years of arbitrary prosecution and persecution of crypto companies where the SEC wouldn’t tell founders what the rules were, but then … would prosecute them.”

Sacks said that past policies drove innovation around crypto technology offshore. Because U.S. financial assets are “destined to become digital” like many other areas, value creation should happen within the country, he said.

Onshore crypto activity will also improve consumer protections, Sacks noted. Activities within the U.S. are easier to supervise, he said, adding that it was “not a coincidence” that FTX committed fraud while based in The Bahamas.

In a question period, Sacks added that the working group would examine the possibility of a Bitcoin reserve as one of its first actions. He noted that Trump’s recently announced sovereign wealth fund is a separate matter.

Sacks acknowledged that the SEC has set up a separate crypto task force, headed by Commissioner Hester Peirce. The SEC similarly wants more open regulation.

Sacks said his working group is further tasked with advancing stablecoin policy and explained that the group will collaborate with the House and Senate.

To that end, the press conference addressed a newly introduced stablecoin bill titled Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS).

GENIUS sets rules for stablecoin issuers, including reserve requirements and supervisory, examination, and enforcement rules. The bill also sets rules based on size: while it requires firms that issue over $10 billion in stablecoins to abide by Federal Reserve and OCC rules, it allows smaller issuers to be state-regulated.

GENIUS was introduced in Congress by Senate Banking Committee Chairman Tim Scott and a group of bipartisan senators on Tuesday. During the press conference, Scott called policy efforts a “synergistic approach” between the House, Senate, and White House. He additionally said efforts will democratize access for the working class and make it “easier and less expensive” to do business in the U.S.

Rep. French Hill, also in attendance, said Congress plans to introduce a new crypto market structure bill based on the Financial Innovation and Technology for the 21st Century Act (FIT21). FIT21 passed the House with bipartisan support in May 2024.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.