As the new year begins with optimism across the crypto market, Bitcoin is once again taking the lead with a bullish outlook. The world’s largest cryptocurrency has started 2025 on a strong note, setting the tone for what investors anticipate to be a pivotal year for the asset. With price action holding above crucial levels, the sentiment surrounding BTC and the broader market remains positive, fueled by hopes of further growth and adoption.

CryptoQuant analyst Axel Adler recently introduced a novel metric, the Bitcoin Input Output Ratio, offering fresh insights into the current market dynamics. According to Adler, the ratio presently indicates market equilibrium, suggesting that Bitcoin’s price reflects a balanced state between buying and selling pressures. This new perspective provides a clearer lens for understanding BTC’s recent movements and hints at potential shifts in the weeks ahead.

With a strong start to the year and a bullish sentiment dominating investor conversations, the next few weeks will be critical for Bitcoin’s trajectory. As the market looks poised for significant developments, many believe 2025 could mark another milestone year for BTC and the broader cryptocurrency space. All eyes are now on the data and price action as BTC charts its course for the months ahead.

Bitcoin Input Output Ratio: What This Metric Reveals

CryptoQuant analyst Axel Adler has provided valuable insights into Bitcoin’s current market dynamics through on-chain metrics. On X, Adler recently introduced the Bitcoin Input Output Ratio (IOR), explaining its significance and how it reflects the state of the market. This metric offers a granular look at wallet activity, helping analysts and investors interpret shifts in market sentiment.

The IOR measures the activity of BTC wallets by comparing the number of addresses spending or transferring funds (inputs) to those receiving funds (outputs). An increase in the ratio indicates higher spending activity, potentially signaling selling pressure or movement toward exchanges. Conversely, a decrease in the ratio suggests reduced spending activity, which may indicate accumulation or hodling behavior.

When the ratio drops below 1, it reflects a higher number of wallets receiving BTC than those spending it—a potential bullish sign, as it may imply accumulation. For the current Bitcoin bullish cycle, the average IOR value has been 1.05. Presently, the metric sits at 1.04, signaling a state of equilibrium in the market.

Adler emphasizes that while the IOR provides valuable information, it should be analyzed alongside other on-chain metrics and broader market conditions to form a complete picture of BTC’s trajectory. This equilibrium phase suggests a balanced market, leaving room for potential shifts in either direction based on external catalysts.

BTC Holding Strong: Time For A Rally?

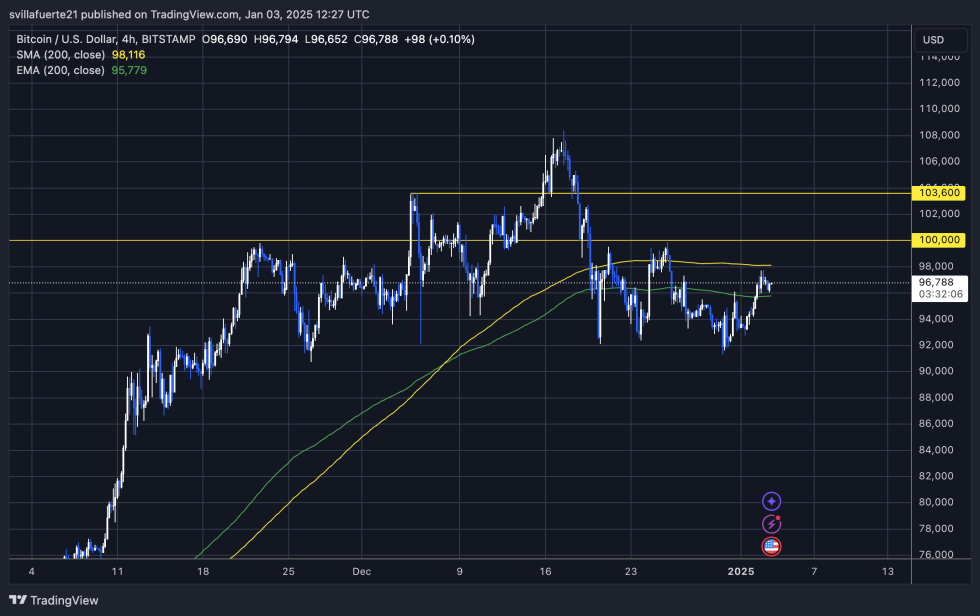

Bitcoin continues to show resilience as it holds above the critical $95,000 mark, a key level for maintaining bullish momentum. This price level has become a focal point for both bulls and bears, as it serves as the foundation for a potential breakout above the highly anticipated $100K mark.

Currently, BTC is trading within a tight range, with the 4-hour 200 EMA below at $95,779 and the 200 MA above at $98,116. This range highlights a period of consolidation, with traders eagerly watching for a clean breakout in either direction. A decisive move above the 200 MA and a successful retest to establish it as support would set the stage for a new rally into uncharted territory and potential all-time highs.

On the other hand, failure to hold these levels could signal brewing bearish momentum. Losing the $95,000 mark, in particular, may lead to a deeper correction as the market searches for the next significant demand zone.

As the market remains in a state of equilibrium, Bitcoin’s next move will likely set the tone for the broader crypto market. All eyes are on whether bulls can gather the strength needed to take BTC to new heights.

Featured image from Dall-E, chart from TradingView