Solana (SOL) finds itself at a critical juncture as it tests demand at a price level that previously acted as key resistance. Since late November, SOL’s price has been in a retrace, dampening the hype surrounding the cryptocurrency. The prolonged decline has left investors uncertain about the next move for Solana, with many questioning whether it can regain its bullish momentum.

Related Reading

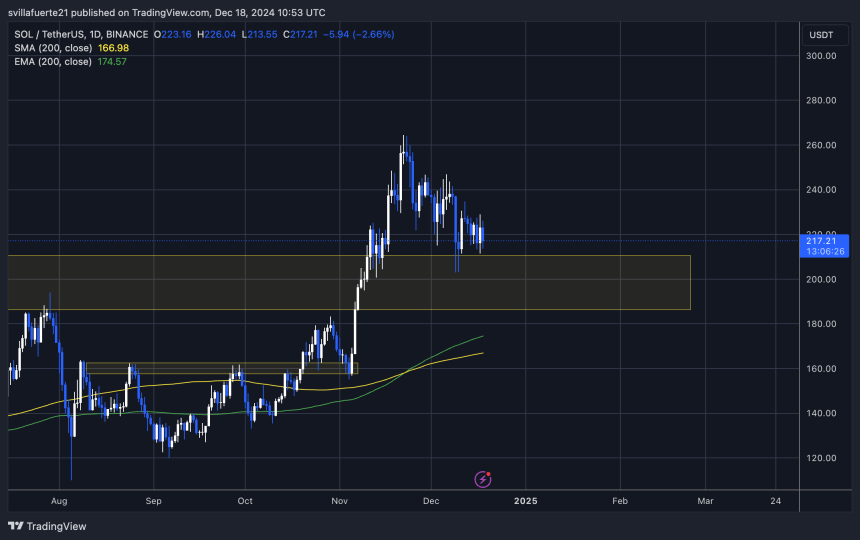

Top analyst Jelle recently shared a technical analysis on X, shedding light on Solana’s current setup. According to Jelle, Solana has formed a falling wedge pattern—a classic bullish formation—into what was once a critical resistance level. The price has confirmed this level as support, providing a potential foundation for a significant rally in the near term.

If the support holds, it could reignite bullish sentiment and position Solana for another strong run. However, a failure to sustain this level may signal further downside, potentially eroding confidence in its long-term trajectory. As Solana navigates this pivotal moment, all eyes are on whether it can reclaim its former glory and capitalize on the momentum.

Solana Finding Fuel To Take Off

Solana has experienced a 23% retrace from its local high of $264, set on November 22. Despite this decline, the cryptocurrency is holding firm above the $210 level, a crucial support zone that has analysts optimistic about a potential rally to new all-time highs. The resilience shown by SOL at this level suggests that bullish momentum may be building as the price consolidates.

Top analyst Jelle recently shared his insights on X, highlighting a bullish technical setup for Solana. According to Jelle, SOL has formed a falling wedge pattern, a structure often indicative of an upcoming breakout. Importantly, the wedge aligns with a key resistance level that has now been confirmed as support, strengthening the case for further upward movement.

Jelle also points out that Solana has formed its first higher low during this retracement, a potential signal that the asset is poised to resume its bullish trend. He believes Solana could re-enter price discovery before Christmas, forecasting a target of $300 in the coming days.

Related Reading

However, risks remain, particularly if the consolidation phase continues for longer than expected. Should SOL fail to break out decisively, it could struggle to regain the upward momentum necessary to challenge new highs. For now, Solana’s ability to hold above $210 will be critical in determining its next move.

Testing Reactive Demand

Solana finds itself at a critical turning point, trading at $216 and holding firm above the $210 mark—a level that once acted as significant resistance. This key support level now plays a pivotal role in determining whether SOL can ignite a historic rally. The current price action reflects growing optimism among investors, with many anticipating that staying above $210 for just a few days could trigger a sharp recovery.

Analysts suggest that if SOL maintains its foothold above this critical level, a swift move toward $250 would likely follow. Such a recovery would position Solana to regain its bullish momentum and potentially challenge its all-time high (ATH). While this scenario might seem ambitious, SOL has previously demonstrated its capacity for rapid upward moves during similar conditions.

Related Reading

A strong confirmation of support at the $210 level could attract fresh buying interest, creating the foundation for the next leg of its rally. With momentum on the horizon, the coming days will be critical in determining whether Solana can make history and aim for unprecedented price levels.

Featured image from Dall-E, chart from TradingView