The Central Bank of Egypt (CBE) announced that Egyptians residing in Gulf countries will soon be able to transfer money directly to Egypt through the InstaPay application, with the service expected to roll out by the end of 2024.

The announcement was made by Ehab Nasr, Assistant Sub-Governor for Banking Operations and Payment Systems, during the 11th “PAFIX” Conference on electronic payments and financial inclusion held on 18 November.

Nasr emphasized that the platform’s robust technological infrastructure can accommodate transactions from any country, ensuring secure and efficient money transfers.

Transfers will be exclusively received in Egyptian pounds, with fees determined by individual banks based on the currency and country of origin.

InstaPay has witnessed rapid growth, with transactions reaching a total value of EGP 1.2 trillion (USD 24.24 billion) by June 2024.

CBE reported that the “InstaPay” payments application registered 2.16 million users within its first year of operation. During this period, the app facilitated 20.3 million transactions, amounting to a total value of EGP 112.7 billion ( USD 2.28 billion).

The volume of transactions is projected to increase to 1.5 billion (USD 30.30 million) by the end of the year, with an estimated total value of EGP 2.6 trillion (USD 52.51 billion)

The service expansion aligns with Egypt’s digital transformation goals, supported by a significant rise in financial inclusion rates from 27 percent in 2016 to 71 percent by mid-2024.

This progress forms part of the ICT 2030 strategy, which focuses on building a Digital Egypt by enhancing infrastructure, fostering digital inclusion, encouraging innovation, and advancing Egypt’s global standing.

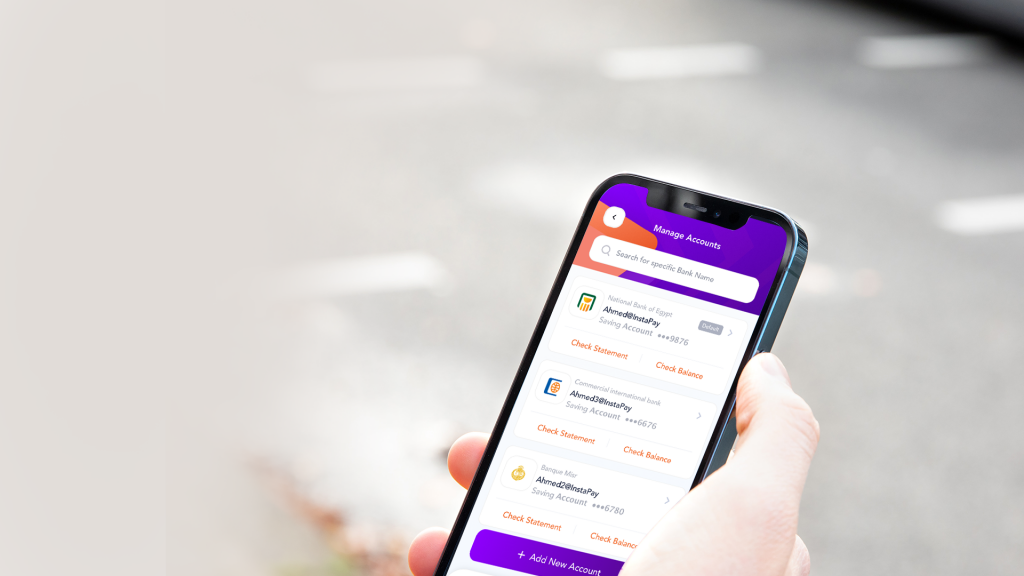

InstaPay, operational 24/7, facilitates secure, instant bank transfers with transaction limits set at EGP 70,000 (USD 1,414) per transaction and EGP 400,000 (USD 8,079) monthly.

Future plans for InstaPay include the launch of a merchant payment service in 2025, further enhancing its offerings in the digital payment landscape. The move reflects CBE’s commitment to modernizing financial systems and promoting economic resilience.